This article includes a list of fees regarding RedotPay Cards. RedotPay presents an innovative solution for those looking to integrate cryptocurrencies into their daily transactions. You can quickly register through the registration page, register now and instantly receive $5, plus a $5 card activation promotion, which means zero cost to activate the card..

Below, we’ve elaborated on each of the listed fees based on common practices in the financial industry:

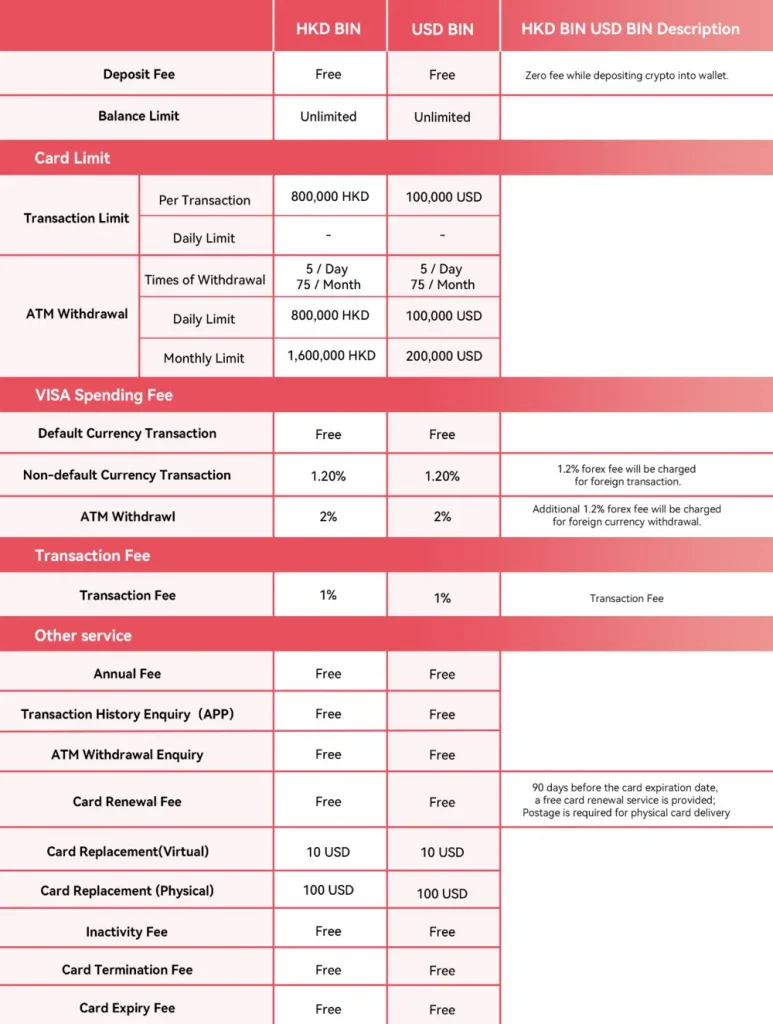

List of Fees

RedotPay Card Purchase Fees

A physical card incurs a purchase fee of $100, while a virtual card can be obtained for a $10 fee. The fee for replacing either type of card is equal to its respective purchase fee.

- Virtual Card: $10 fee

- Physical Card: $100 fee

Recharge: No fee

Recharging or topping up your card balance typically incurs no fees, making it straightforward for users to add funds to their card without worrying about additional costs. This feature is particularly attractive for those who frequently need to reload their card for various spending needs.

Local Currency Spending: No fee

Spending in your default currency using the card does not incur any fees, which is an excellent feature for everyday use. Whether you’re buying groceries, paying for gas, or shopping online, you can use the card freely without extra charges as long as the transaction is in the default currency.

Non-Default Currency Spending: 1.2% foreign exchange fee

For transactions in a non-default currency, a 1.2% foreign exchange fee applies. This fee compensates for the currency conversion process involved in such transactions. While this is a relatively low fee compared to many other cards, frequent travelers or those making regular purchases in foreign currencies should consider this cost.

ATM Withdrawals: 2%

Withdrawing cash from ATMs incurs a 2% fee. This fee is applied to cover the costs associated with ATM network usage and processing the cash withdrawal transaction. Users planning to withdraw cash often should factor in this cost, especially in scenarios where accessing cash is necessary. (Additional 1.2% forex fee will be charged for foreign currency withdrawal)

Transaction Fee: 1%

A general transaction fee of 1% applies to certain operations or transactions made with the card. This fee could be related to specific types of transactions outside of regular purchases, such as transferring funds or potentially for transactions that involve more processing.

Annual Fee: None

The absence of an annual fee is a significant benefit, making this card an attractive option for long-term use without worrying about a recurring charge simply for having the account open.

Card Renewal: Free

When the card expires, renewing it incurs no additional cost. This policy ensures users can continue using their card without interruption or the need to pay for a new one upon expiration.

Account Management Fee: None

There are no fees associated with managing your account, which typically includes checking your balance, reviewing transaction history, and updating personal information. This feature makes it easier for users to keep track of their finances without extra charges.

Conclusion

These details about the fees and charges associated with the card offer a clearer picture of the potential costs involved in using the card. Overall, it’s a very practical card for digital currency owners. If interested, you can register here.