RedotPay has recently announced updates to its fee structure for both virtual and physical cardholders, effective from October 25, 2024. Let’s break down what these changes mean for you, whether you’re applying for a new card or managing your existing accounts.

Card Application Fees

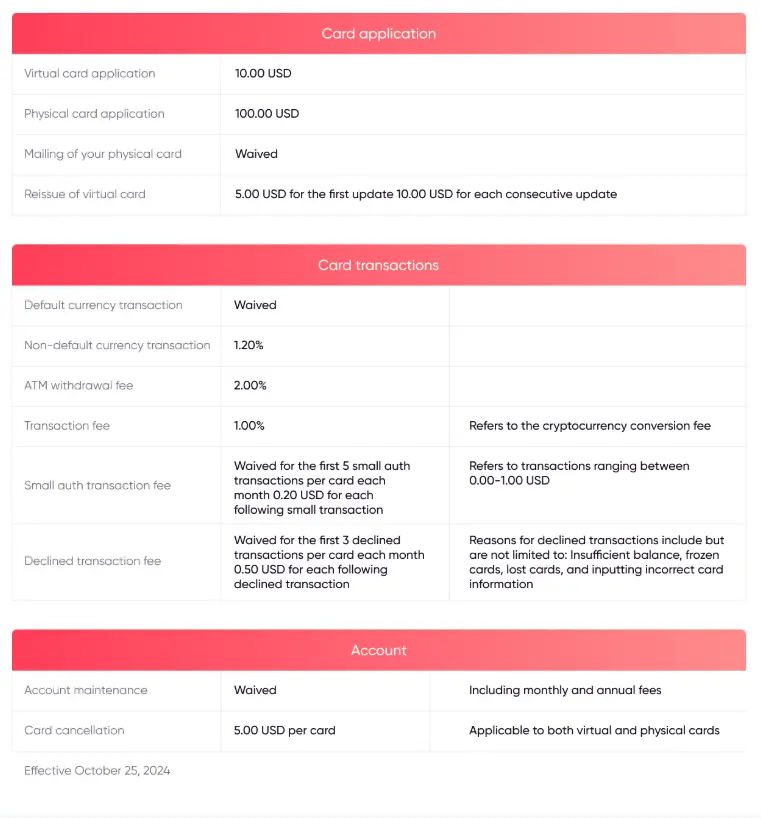

- Virtual Card Application: Applying for a new virtual card costs $10.

- Physical Card Application: The fee for a new physical card application is significantly higher, set at $100.

- Mailing of Your Physical Card: RedotPay waive any fees associated with mailing your physical card.

- Reissue of Virtual Card: The reissue fee for virtual cards costs $5 for the first update, with each consecutive update costing $10.

Transaction Fees

- Default Currency Transactions: There are no fees for transactions made in the card’s default currency, maintaining ease and affordability in primary markets.

- Non-default Currency Transaction: For transactions not in the card’s default currency, a fee of 1.20% of the transaction amount will be charged.

- ATM Withdrawal Fee: Withdrawals from ATMs are now subject to a 2.00% fee.

- General Transaction Fee: All other transactions will incur a fee of 1.00%, which includes cryptocurrency conversion transactions.

- Small Authorization Transaction Fee: The first five small authorization transactions per card each month are waived. Subsequent small transactions will incur a fee of $0.20 each.

- Declined Transaction Fee: The fee for the first three declined transactions per card each month is waived, with a subsequent charge of $0.50 for each additional declined transaction.

Account Maintenance

- Account Maintenance: There are no fees for general account maintenance, which covers both monthly and annual fees.

- Card Cancellation: Cancelling a card now costs $5.00 per card, applicable to both virtual and physical cards.

Tips on Controversial Fees

- Small Authorization Transaction Fee: These fees can quickly add up, especially for those who frequently conduct small transactions. To avoid these charges, consider consolidating smaller purchases into larger transactions where possible.

- Declined Transaction Fee: This fee can be particularly frustrating. Ensure your account is adequately funded, and your card information is up-to-date to avoid unnecessary declines and subsequent fees.

- Card Cancellation Fee: Think carefully before opening multiple cards, and if you need to cancel, ensure it’s necessary to avoid the fee.

Conclusion

The updates to RedotPay’s fee structure are designed to encourage responsible card usage and account management. By understanding and planning for these fees, cardholders can continue to enjoy the benefits of their cards without facing unexpected charges. Remember, managing how you use your card can significantly impact the fees you pay. Keep yourself informed and make adjustments to your spending habits as needed to navigate this new fee landscape efficiently.